The Future of Payments in Japan with WeChat Pay

As the world increasingly embraces cashless transactions, nations face the challenge of adapting to innovative payment solutions. Japan, a country known for its technological advancements, is on the brink of a significant shift in its payment landscape. Enter WeChat Pay, a mobile payment platform revolutionizing how consumers and businesses interact financially. With its integration into daily transactions, WeChat Pay is not only enhancing user experiences but also pushing traditional payment systems to evolve. In this article, we will explore the implications of WeChat Pay’s entry into Japan, its impact on existing payment systems, technological innovations, and future trends.

Introduction to WeChat Pay

WeChat Pay emerged as a key player in the global payment landscape. It is integral to technology-driven markets, providing seamless financial transactions. With over 1 billion users, WeChat Pay facilitated more than $17 trillion in transactions in 2021 alone (Statista). This mobile payment platform connects users through social networking while enabling businesses to enhance their customer experience.

Emerging from China’s rapidly digitizing economy, WeChat Pay has transformed how consumers and merchants interact. Its integration into daily life demonstrates the shift towards cashless finance. By leveraging QR codes and payments through messaging apps, WeChat Pay exemplifies innovative payment solutions in use today.

For more insights on how payment technologies are evolving, check out our article on GrabPay and its influence in Southeast Asia.

WeChat Pay’s Entry into Japan

WeChat Pay’s entry into Japan marks a significant shift in digital payments. The service aims to establish robust partnerships with local businesses, ensuring a seamless user experience for Japanese consumers. Addressing regulatory considerations is crucial for compliance, as Japan has stringent laws governing payment services.

Cultural adaptations are also vital. WeChat Pay plans to incorporate features familiar to Japanese users, enhancing its overall acceptance. This strategy helps in building trust and encourages local merchants to adopt the platform.

Furthermore, successful integration will likely depend on understanding local payment preferences and online behaviors. Such insights can elevate WeChat Pay above its competitors, promoting increased usage rates.

As the digital payment landscape evolves, exploring trends in other regions, like GrabPay in Southeast Asia, can provide valuable insights for WeChat Pay’s adaptation strategies. Significantly, this launch could reshape consumer payment practices in Japan.

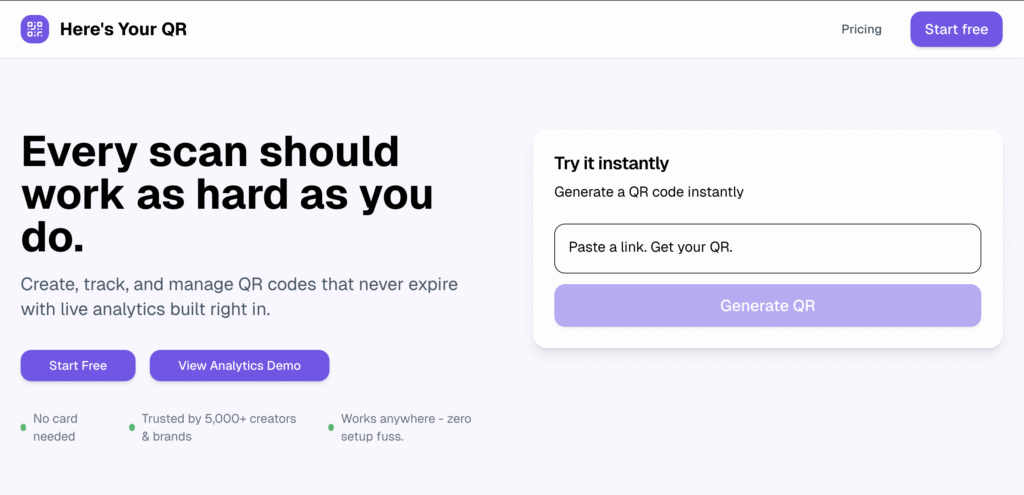

For further insights into QR code utilization in retail environments, check out how dynamic QR codes are revolutionizing retail.

Impact on Japanese Payment Systems

WeChat Pay is significantly influencing traditional payment systems in Japan. As consumers experience the convenience of digital payments, their behavior is shifting towards cashless transactions. Reports indicate that over 70% of Japanese consumers are open to using mobile payment methods in the future, a notable increase from years past (Japan Government). This evolution reflects a growing trend towards digital adoption.

Market competition is also intensifying. WeChat Pay’s entry has intensified rivalry among existing players, prompting traditional banks and credit card companies to innovate. Companies are updating their platforms to offer features that match or exceed WeChat Pay’s capabilities. The integration of QR codes in payment processes has further accelerated this trend, enhancing user experience across the board.

As consumer preferences shift, the future of payments in Japan looks dynamic. For insights into other regions, check GrabPay in Southeast Asia or explore UPI in India. Digital payment systems are not only changing the retail landscape but also encouraging traditional platforms to evolve continuously.

Technological Innovations Driving Change

WeChat Pay leverages various technological innovations to thrive in Japan. Mobile payments offer a seamless experience, allowing users to transact instantly. This convenience appeals to consumers seeking efficiency in their payment methods.

Blockchain integration enhances security and transaction transparency. By utilizing distributed ledger technology, WeChat Pay assures users of secure transactions. This integration significantly reduces fraud risk, making it a trusted platform.

Moreover, robust security measures are in place to protect user data. Encryption and two-factor authentication are standard practices for maintaining user trust. As digital payments grow in popularity, these innovations are crucial for sustaining user confidence.

- Advanced mobile payment solutions

- Blockchain for enhanced security

- User-focused security measures

For deeper insights into the future of digital transactions, check out our related content on GrabPay’s impact in Southeast Asia.

Future Trends in Digital Payment Solutions

Japan’s payment systems are evolving rapidly, influenced by innovations like WeChat Pay. These digital payment solutions offer significant opportunities, yet they also present various challenges. The integration of advanced technologies can enhance user experiences and streamline transactions.

One key trend is the rise of mobile wallet services. As consumers demand seamless and swift payment options, services similar to WeChat Pay will gain traction. This can potentially lead to reduced reliance on cash and traditional banking.

However, challenges exist, such as regulatory hurdles and data security concerns. Ensuring consumer trust will be vital in adopting these solutions widely. Additionally, there is a need for constant technological updates to handle increasing transaction volumes.

Innovations like QR codes are crucial in this landscape. They allow for contactless transactions and can be easily integrated into various payment platforms. For more on the role of QR codes in retail, check out our article on dynamic QR codes.

In conclusion, while Japan’s digital payment future appears promising, it will require collaboration among stakeholders to address emerging challenges. The landscape will continue to evolve, spurred by innovations and changing consumer expectations.

Conclusion: The Future of Payments in Japan

WeChat Pay holds a transformative potential for the future of payments in Japan. As a major player in mobile transactions, it can reshape how consumers and businesses interact financially. With its rapid adoption in various sectors, WeChat Pay aligns with Japan’s tech-savvy culture.

The integration of WeChat Pay could streamline payment processes while enhancing customer experience across industries. This shift may encourage the adoption of other digital payment systems in Japan, fostering competition and innovation.

Moreover, the growing trend of mobile payments indicates a shift towards frictionless transactions. As consumers increasingly prefer contactless solutions, WeChat Pay and similar services are likely to play a significant role in shaping this landscape. For more insights, explore how GrabPay is influencing the future of payments in Southeast Asia.

In conclusion, the future of payments in Japan looks promising with WeChat Pay at the forefront. Its impact may be pivotal in modernizing payment systems, leading to greater convenience and efficiency for consumers.

Key Takeaways

WeChat Pay has significantly influenced Japan’s payment systems, reshaping how transactions occur. Its seamless integration of QR code payments has spurred local innovations and adoption. The platform’s user-friendly interface has encouraged consumers and businesses to embrace mobile payments more readily.

Moreover, WeChat Pay’s presence signals a shift towards cashless transactions in Japan. This change is critical as consumers seek more convenience in their purchasing methods. Additionally, local businesses are adapting, enhancing their payment systems to remain competitive.

Looking ahead, Japan’s payment landscape may see further advancements inspired by WeChat Pay. With the rise in demand for quick and efficient payment options, local technologies may emerge that cater specifically to consumer needs.

To learn more about payment innovations in Asia, explore insights on GrabPay and its regional impact, or check out our blog category for the latest trends.

FAQ About WeChat Pay in Japan

WeChat Pay has transformed how users and merchants interact in Japan. Below are some frequently asked questions regarding its functionalities and impact.

What is WeChat Pay?

WeChat Pay is a mobile payment solution integrated with the WeChat app. It allows users to make purchases, pay bills, and transfer money easily.

How does WeChat Pay work for merchants?

Merchants can accept payments through QR codes generated for their accounts. This QR code scanning is fast and efficient, streamlining the payment process.

Is WeChat Pay popular in Japan?

While it’s more popular in China, WeChat Pay is growing in Japan, attracting tourists and local users who prefer digital payments.

What are the benefits for users?

Users enjoy convenience and quick transactions. They can easily manage payments without carrying cash or cards.

How does WeChat Pay impact local businesses?

For merchants, adopting WeChat Pay can attract a broader customer base. It enhances customer experience and increases sales potential.

For further insights about mobile payment solutions, refer to our dynamic QR codes article.

Conclusion

Embracing digital payment technologies is crucial for Japan’s economic future. As the nation evolves, these innovations will enhance efficiency and convenience in financial transactions.

The integration of technology such as QR codes and mobile payments can transform consumer behavior. Digital payments simplify everyday purchases, driving growth in various sectors.

Furthermore, adopting these technologies fosters a more competitive marketplace. As businesses leverage digital tools, they can attract a broader audience and enhance customer experiences.

In conclusion, Japan’s readiness to embrace this shift will determine its economic landscape. For more insights on digital payment trends, visit our blog.

For more resources, consider exploring our internal page to create your first dynamic QR now by searching for “create qr”.